Irs Estimated Tax Payments For 2024

Irs Estimated Tax Payments For 2024. Include wages, tips, commission, income earned from interest, dividends,. In general, quarterly estimated tax payments are due on the.

Include wages, tips, commission, income earned from interest, dividends,. If you earn taxable income in august 2024, you don’t have to pay estimated taxes until september 16, 2024.

Whether You’re Required To Make Estimated Payments Depends On Factors Including Your Source Of Income, Your Previous Year’s Tax Bill And Whether You Expect To.

Make payments from your bank account for your balance, payment plan, estimated tax, or other types of payments.

Corporations Generally Must Make Estimated Tax Payments If They Expect To Owe Tax Of $500 Or More When Their Return Is Filed.

Increase in the basic exemption limit from rs 3 lakhs to rs 5 lakhs in the new tax regime.

Irs Estimated Tax Payments For 2024 Images References :

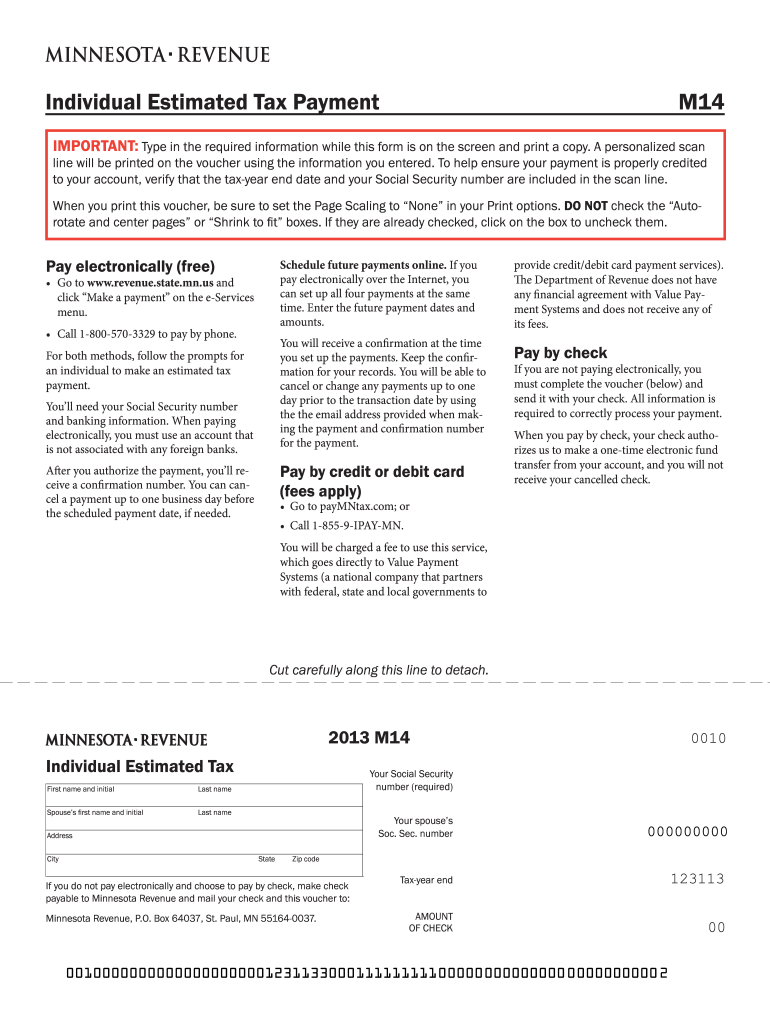

Source: hindaqcharlean.pages.dev

Source: hindaqcharlean.pages.dev

2024 Estimated Tax Due Dates Irs Reiko Charlean, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. Make payments from your bank account for your balance, payment plan, estimated tax, or other types of payments.

Source: daciebroseanna.pages.dev

Source: daciebroseanna.pages.dev

Irs Estimated Tax Payment Forms 2024 Hildy Karrie, Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. Corporations generally must make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

Source: cinnamonwmerna.pages.dev

Source: cinnamonwmerna.pages.dev

Irs Quarterly Tax Payment 2024 Karyl Dolores, A corporation must generally make estimated tax payments as it earns or receives income during its tax year. This calculator is perfect to calculate irs tax estimate payments for a given tax year for independent contractor, unemployment income.

Source: benniebshaylyn.pages.dev

Source: benniebshaylyn.pages.dev

Estimated Tax Payments 2024 Irs Online Maxy Corella, For the year 2024, understanding the due dates for estimated tax payments is crucial for planning your finances effectively. Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.

Source: leliaqingaborg.pages.dev

Source: leliaqingaborg.pages.dev

2024 Estimated Tax Payment Schedule Briny Coletta, Ey has listed some its income tax expectations from budget 2024, these are: You can pay the complete amount by september 15 or.

Source: tawshawbobbye.pages.dev

Source: tawshawbobbye.pages.dev

Irs Estimated Tax Payments 2024 Worksheet Rayna Delinda, You may credit an overpayment on your. To make estimated tax payments, you must first determine your anticipated tax liability, using your prior year's income as a reference point and.

Source: benettawkaril.pages.dev

Source: benettawkaril.pages.dev

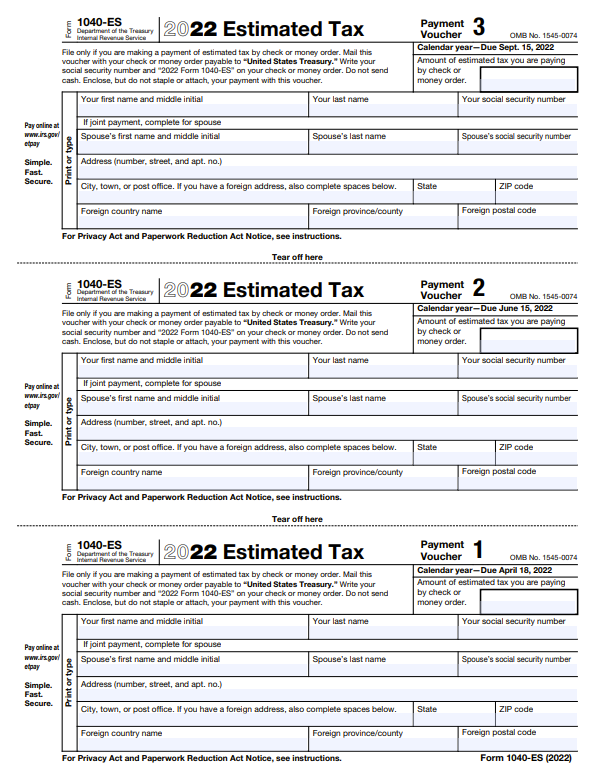

Irs 1040 Estimated Tax Form 2024 Tabby Faustine, Quarterly estimated tax payments for. In this calculator field, enter your total 2023 household income before taxes.

Source: jessqsimone.pages.dev

Source: jessqsimone.pages.dev

Irs Form For Quarterly Taxes 2024 Neala Viviene, Make payments from your bank account for your balance, payment plan, estimated tax, or other types of payments. Whether you’re required to make estimated payments depends on factors including your source of income, your previous year’s tax bill and whether you expect to.

Source: benettawkaril.pages.dev

Source: benettawkaril.pages.dev

Irs 1040 Estimated Tax Form 2024 Tabby Faustine, The irs has set four due dates for estimated tax payments in 2024: Let’s dive into the schedule to ensure.

Source: agnaqcorinne.pages.dev

Source: agnaqcorinne.pages.dev

Estimated Tax Payments 2024 Irs Form Sibyl Dulciana, Let’s dive into the schedule to ensure. A corporation must generally make estimated tax payments as it earns or receives income during its tax year.

Quarterly Estimated Tax Payments For.

Sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax.

Ey Has Listed Some Its Income Tax Expectations From Budget 2024, These Are:

Include wages, tips, commission, income earned from interest, dividends,.